• Tight at the top: The Chicago Bears and Houston Texans basically share first place, with the Bears dominating in cap space and the Texans dominating in draft capital.

• The Buccaneers on the brink: Tampa Bay currently ranks dead last in terms of offseason assets and should consider refraining from using its restructure potential and instead start a rebuild.

• Detroit's future looks bright: The Detroit Lions almost made the playoffs in 2022. They were arguably the fourth-best team in the NFC and fielded a top-five offense. They haven't lost significant coaching intel and now rank fourth in the league in offseason assets.

Estimated reading time: 9 minutes

The offseason is a season of hope, as almost every NFL team will hope to eliminate the weaknesses that kept them from reaching the Super Bowl.

To eliminate weaknesses and improve in general, teams can use their draft capital and cap space in various ways to increase the overall quality of their rosters. In this article, we will rank teams by their offseason assets.

Draft capital

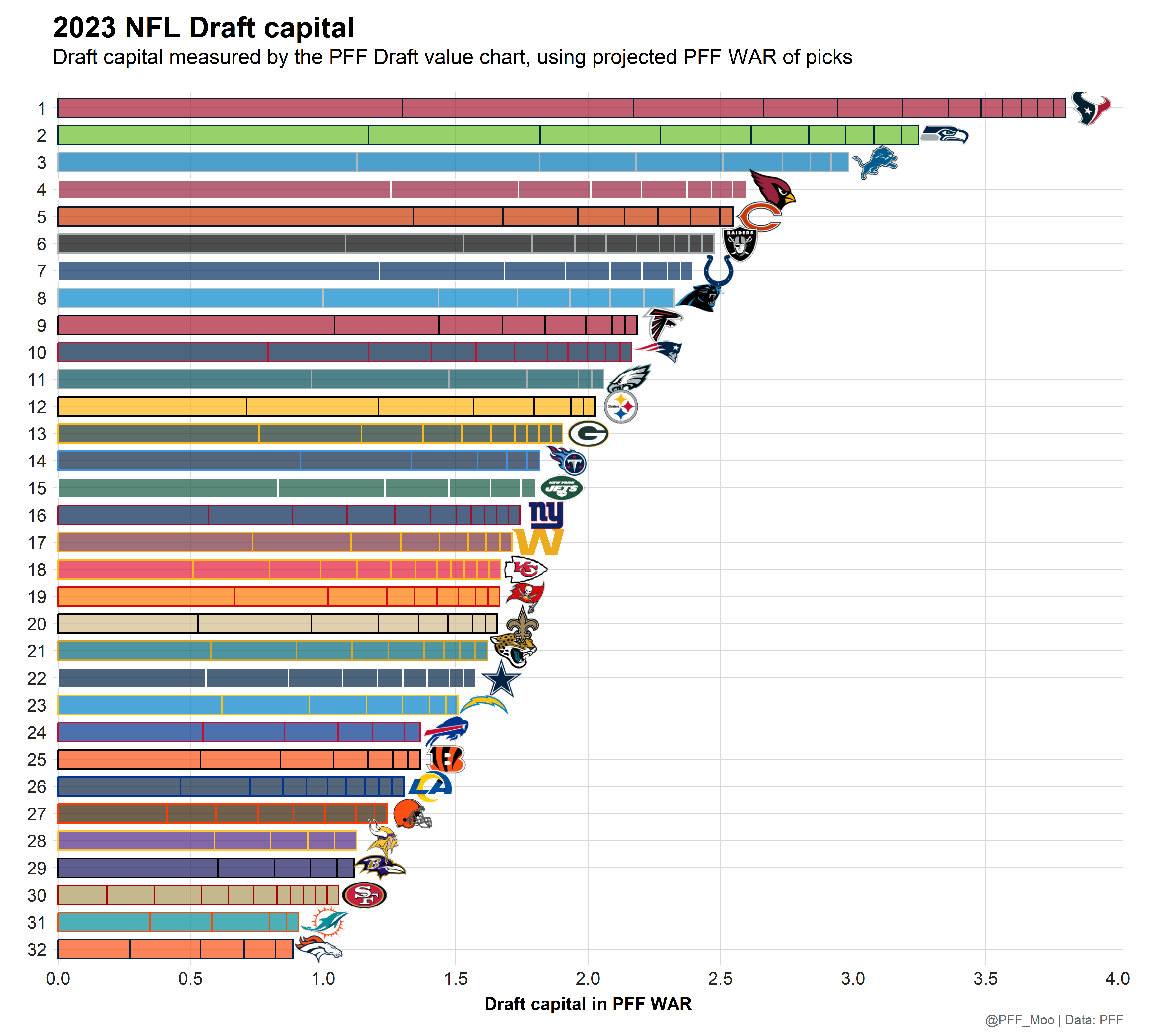

Ranking teams by draft capital is fairly straightforward. We use the PFF draft value chart to measure the value of all a team's draft picks.

The PFF draft value chart estimates the value of a draft pick by projecting the amount of PFF WAR (wins above replacement) a player drafted at that pick generates during his first four years — the length of the rookie contract — on average.

The following chart illustrates every team's draft capital, with the value of each individual pick being shown in each team’s bar.

The Houston Texans gave away the first overall pick of the 2023 NFL Draft by beating the Indianapolis Colts in Week 18, but they still lead the league in draft capital because they also have the Browns’ first- and third-round picks.

Nevertheless, The Texans either have to trade up to the No. 1 pick or hope the Chicago Bears stay put and select a pass-rusher if they are to pick the quarterback they like most.

Right now, it doesn’t look like the Bears would do them this sort of favor.

The Bears, who currently own the first overall pick, rank just fifth in total draft capital, mostly because they traded away what will now be the 32nd overall pick in exchange for wide receiver Chase Claypool — a deadline move they probably regret by now.

Cap space

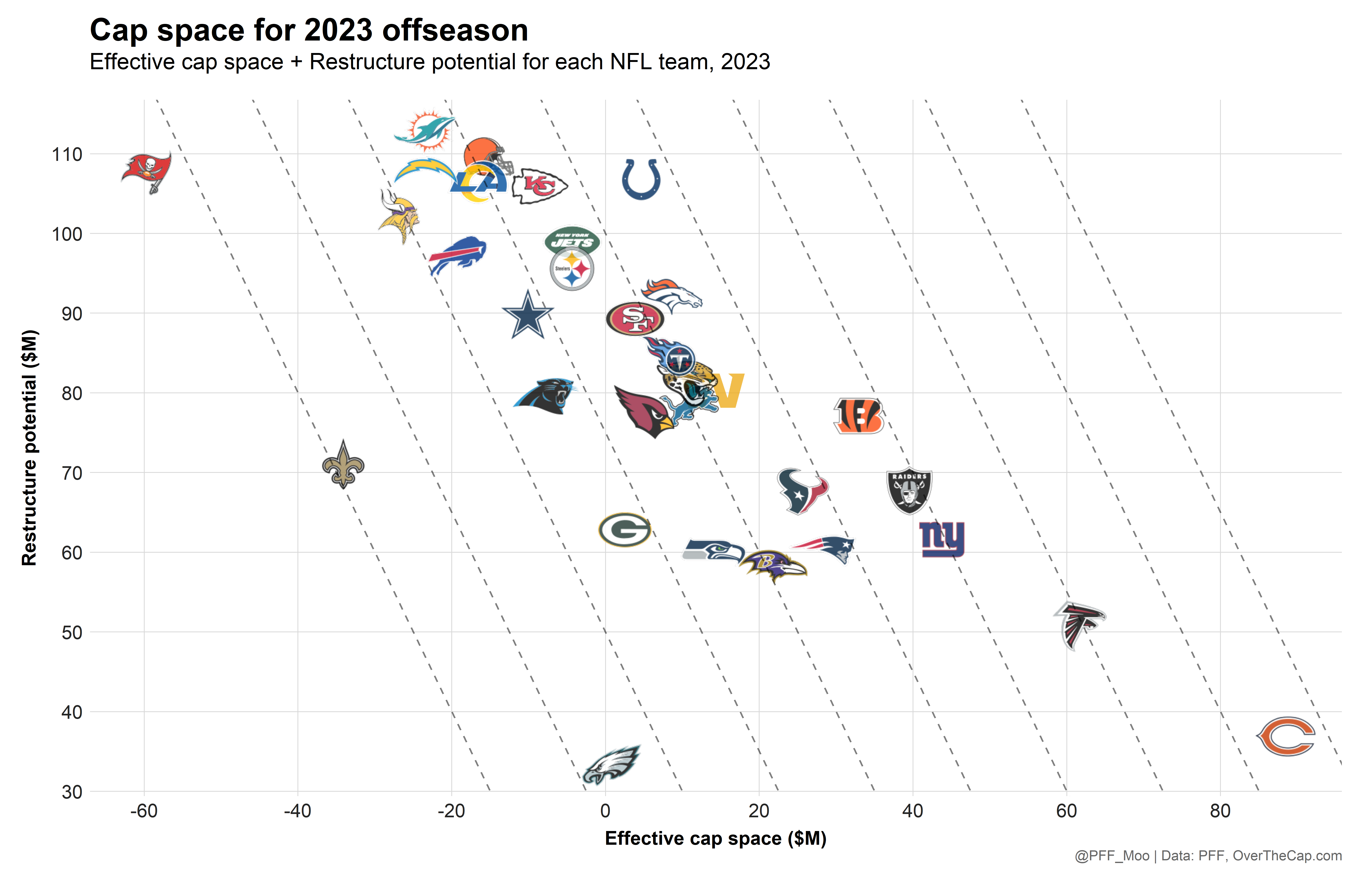

It is not as straightforward to rank teams by cap space, as cap space is much more fluent. Nevertheless, we can look at two key metrics provided by our friends at OverTheCap.com:

• Effective cap space is just the available cap space of a team minus the cap its rookie class will cost.

• On top of using their effective cap space, teams can increase their cap space without changing their roster by restructuring existing contracts through converting base salary to signing bonus which is prorated over multiple years. This saves cap for the current year but pushes all of the saved cap into the future.

We will call the potential to the latter restructure potential. This counts how much cap a team could save for 2023 if they:

• Restructure all their existing contracts by the maximum amount — prorate every dollar of base salary up to the minimum base salary over the existing future years of all their contracts. These are called simple restructures.

• Go even further when it comes to saving 2023 cap by adding additional void years to existing contracts or extending existing contracts with new money to save base salary in 2023. These are called maximum restructures.

Notably, restructure potential isn’t equally valuable as effective cap space. For example, having $50 million in cap space is better than having $50 million in restructuring potential.

Cap space can be used flexibly and can even be carried over to the next season, while every dollar saved through restructures is guaranteed to hit the cap in future years.

Another way of saying that is that draft capital and effective cap space can be used to get a better team over the next several years, while restructure potential can almost exclusively be used to get better (or at least not get worse) for the upcoming season at the cost of having less wiggle room in the future.

That’s why teams with a realistic window of competing for a deep playoff run should mostly take advantage of their high restructure potential.

The chart below shows each team's effective cap space and restructure potential. The anti-diagonal lines are chosen such that we consider restructure potential half as valuable as effective cap space.

That’s not only an arbitrary downranking of restructure potential, but it also reflects the reality that teams barely use all of their theoretical restructure potential.

There is an obvious negative correlation between effective cap space and restructure potential, which makes sense intuitively.

Restructure potential is almost 100% correlated to the amount of base salary the team has to pay their players in 2023 with the existing contracts. Obviously, the more base salary a team has to pay, the less effective cap space it will have.

For example, the Bears have very few expensive players under contract and therefore have a lot of effective cap space, but this also means they have little in the way of restructure potential because they aren't currently set to pay a lot of base salary in 2023.

A combined ranking

Exclusive content for premium subscribers

WANT TO KEEP READING?

Dominate Fantasy Football & Betting with AI-Powered Data & Tools Trusted By All 32 Teams

Already have a subscription? Log in

© 2025 PFF - all rights reserved.

© 2025 PFF - all rights reserved.